The retail sector has a well-earned reputation as one of the most challenging industries for participants to navigate successfully. Retailers – be they traditional brick and mortar companies, online sellers or, often, a combination of the two – must manage complex supplier relationships and inventories while also catering to the sometimes mercurial wants and needs of their end customers. For retailers, “supply and demand” is more than a trite catchphrase. Rather, it encapsulates an ever-shifting and intricate relationship that demands real-time data, accurate forecasting and efficient operations if the retailer is to generate profits in a business characterized by razor-thin margins.

In short, retailers truly need a 360-degree view of their business, encompassing suppliers, consumers and the many processes that connect the two. With little room for error, retailers and etailers must not only track critical operational metrics closely, they must continually strive to make their processes more efficient and effective.

Retailers sit at the nexus between wholesalers and distributors on one side, and end buyers on the other. They must deal with product availability and pricing demands from their suppliers, while keeping their store offerings competitively priced and in line with current customer demands. As friction-free online shopping options proliferate, maintaining customer loyalty as well as profitability is proving increasingly elusive. Among the operational challenges retailers face:

Retail businesses encompass supply-side and demand-side

Supplier-side Challenges:

Product availability and pricing: All but the largest of retailers are at the mercy of their suppliers, who can set prices close to retail selling prices and whose products may not always align with changing customer demands.

Incoming inventory management: Retailers need to maintain inventory levels and mixtures aligned with the current and forecasted consumer preferences, which aren’t always the same as the suppliers’ preferences and product lines.

Buyer-side Challenges:

Outgoing inventory management: Retailers must have good visibility into inventory levels and purchasing trends to ensuring that inventories are stocked to meet both current and future demands, while limiting overstocking and forced discounting.

Customer satisfaction: In addition to ensuring that they have the right product selection and price points, retailers must work to engender customer loyalty while also increasing the number and value of products each customer buys.

Commerce operations: As higher percentages of retailers enter the online selling realm, they must deal with everything from cart abandonment rates to rapid and accurate processing of orders and shipments.

In addition to the above challenges, retail and distribution business today need to think globally. Digital commerce enables them to setup web-shops and transact beyond their geographic borders and becomes players in a global economy. This is where SAP Anywhere will benefit from being part of the larger SAP company. Most global businesses need more accurate multi-currency exchanges. Does the solution calculate financials in local currencies and support local tax compliance? What languages does it support?

Having a reputable cloud provider handle these and other critical business processes – as well as providing the platform for commerce sites in some instances – frees companies from performing these tasks, which are often outside of their areas of core competency.

Target Market:

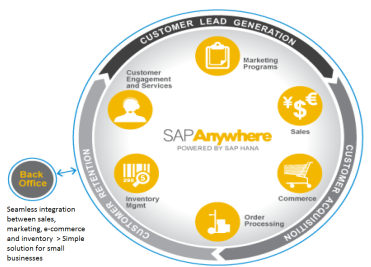

SAP Anywhere is targeted at companies with between 10 and 500 workers. Built from the ground up for the SMB market. It leverages SAP HANA to mine the data for real-time analytics and insights.

SAP Anywhere is a cloud-based solution, it will be delivered as SaaS (software as a service) by SAP in a public cloud (Amazon cloud for the US market). While it can be accessed through either mobile devices or desktops, SAP is emphasizing that it will allow SMBs to manage their business from anywhere using their mobile devices.

Perspective and Go-to-Market Channel Implications:

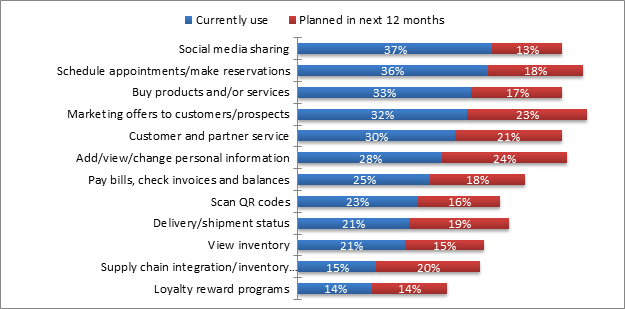

SMB spending on digital commerce solutions is increasing, especially for solutions that are simple and aimed at improving customer experience across mobile, social and web. This new category of front-office solution for small businesses will open new doors for SAP and will necessitate a new channel approach. In North America SAP plans to develop new channels where SAP has not gone before for SAP Anywhere and not restrict it to their existing Business One channel partners. There is also potential for affiliate partners like PayPal, eBay, Facebook, etc. Success with SAP Anywhere will also require partnerships with other type of affiliate solution providers, as part of an expanded ecosystem, that can help specialized SMBs setup sophisticated web-presence instead of the generic out-of-box experience.